As the Belgian market remains weighted towards capital protection, returns lag behind those achieved in neighbouring France where the yield enhancement segment is much more developed.

In the past 18 months, market parameters have changed with higher interest rates allowing for better risk/return profiles for capital protection products, however prior to that investors had to sacrifice protection when hunting for yield, or indeed trade off higher yield if protection remained a priority.

In this article we compare performances for products that matured or expired in Belgium and France between 1 January 2016 and 30 September 2023.

In Belgium, some 2,879 structured products that sold US$95 billion at inception reached their maturity during the period, against 2,941 products worth US$98 billion that matured in France, according to SRP data.

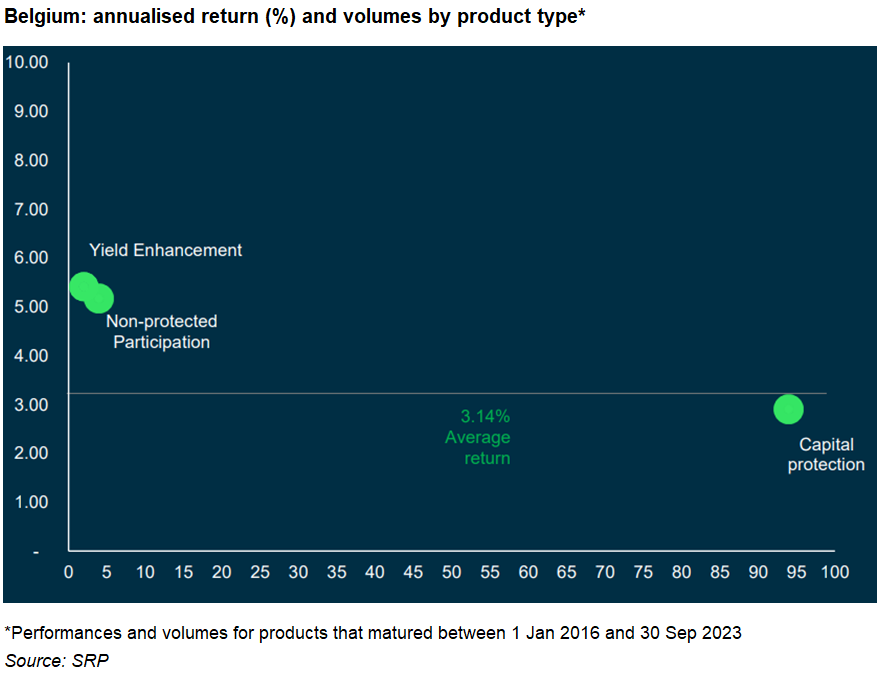

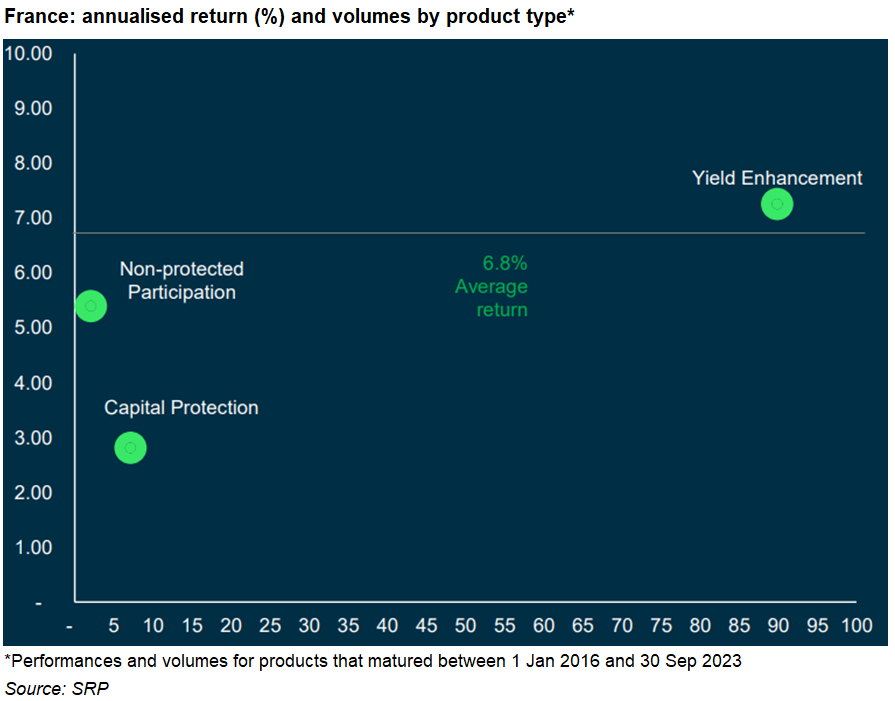

The average annualised return in Belgium, at 3.1% per product, was less than half of those achieved in France, where products returned on average 6.8% per annum.

Despite being neighbours, when comparing the preferred product types of investors, both countries are worlds apart. In Belgium, 94% of all maturing sales volumes was invested in capital protection products, which achieved average annualised returns of 2.9%, with participation products making up four percent of the market (5.2% pa) and yield enhancement products having a market share of just two percent (5.4% pa).

In France, the complete opposite happened. Here, maturing yield enhancement products grabbed a market share of 90% in the period, offering average annualised returns of 7.3%, compared to a three percent and seven percent share for participation products (5.4% pa) and capital protection products (2.8% pa), respectively.

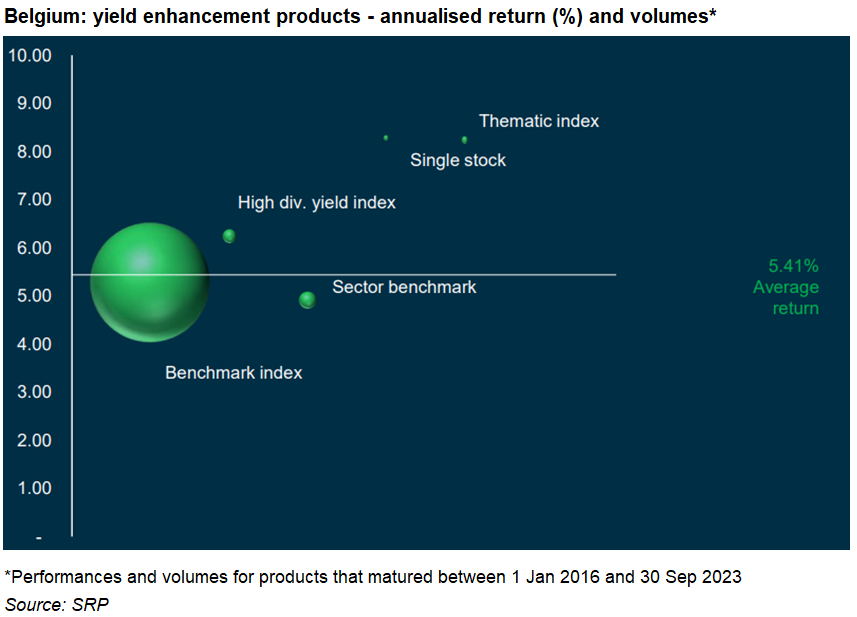

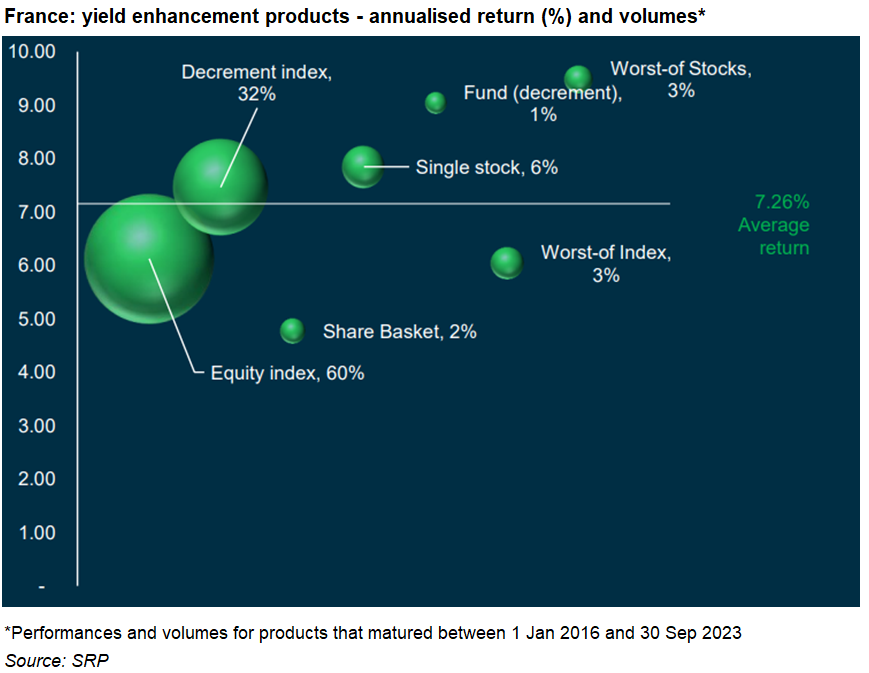

In both countries, yield enhancement products provided the highest annualised returns, although in Belgium volumes of products redeeming early in this segment were on a different level altogether (i.e. much smaller) compared to those in France: US$650m vs US$75 billion.

In Belgium yield enhancement product delivered an average annualised return of 5.4%. Around US$625m (the equivalent of almost 97% of the total volumes for this product type in the country) was invested in products linked to a benchmark index that generated average annualised returns of 5.3%.

French yield enhancement returns averaged 7.3% pa, with equity indices claiming 92% of all volumes sold in this segment (US$64 billion). Of these, decrement indices (32% market share) and other indices (ex-decrement) (60%) paid average annualised coupons of 6.1% and 7.5%, respectively. The highest returns, at 9.5% pa, came from products tied to a worst-of basket of shares, which captured three percent of all yield enhancement linked sales.