BBVA makes a high-profile appointment in APAC, while SRP discusses the gold standard.

Charles Firth, former managing director, head of solution sales, Southeast Asia at Credit Suisse, has joined BBVA’s global markets team based in Hong Kong SAR.

Firth reports functionally to Roberto Vila, global head of sales and structuring, and geographically to Eric Michl, head of global markets, Asia at the Spanish bank, a BBVA spokesperson told SRP.

The seasoned sales executive parted ways with Credit Suisse in September 2023 after 12 years at the bank. Firth relocated from Hong Kong SAR in January 2022 after re-joining the Swiss bank from start-up Rafiki Capital Management in November 2018.

Firth first joined Credit Suisse in 2009 from UBS, as head of equity structuring team, Asia Pacific, a position he held for over seven years. Firth was also instrumental in Credit Suisse becoming a leading player in the structured funds market. Prior to this, Firth was head of the Asian equity structuring team at UBS. He started his career in the region at Barclays Capital’s solutions sales team, where he set up the UK bank’s equity derivative presence in Japan.

Zack Bezuidenhoudt has joined MerQube as senior director business development. Bezuidenhoudt is based in London and tasked with growing market share for MerQube in Europe across investment banks, key ETF providers and asset managers.

Bezuidenhoudt previously was at S&P Dow Jones Indices (S&PDJI) where he spent 10 years, most recently as director client coverage head of Southern Europe. Prior to that he was director client coverage Israel, Benelux and Nordics and before that he was the head of South Africa and Sub-Saharan Africa at S&P DJI.

Bezuidenhoudt joined the US index provider from Old Mutual Investment Group where he fulfilled several roles, including that of senior institutional sales manager and business and product development executive based in Sandton, South Africa. Before that he was an asset consultant and head of surveys at Alexander Forbes, also in Sandton.

Still in the UK, Cirdan Capital Management and Equita agreed on 3 January to resume the listing of products manufactured and issued by SmartETN and Aldburg Public on the CertX segment of the EuroTLX market and on the SeDeX market managed by Borsa Italiana.

The agreement comes after the unilateral suspension of the agreement between the parties announced by Equita on 26 December 2023 following the decision by the Bank of Italy to order the dissolution of the boards of directors of Smart Bank and the parent company Cirdan Group.

The two companies were put under extraordinary administration by the regulator under article 70 of the Consolidated Banking Act for ‘serious irregularities’ on 23 December with the aim of ‘ensuring adequate monitoring of the operations of the group and to restore conditions of sound and prudent management’.

One topic SRP doesn’t tackle often: gold. The backdrop over the last two years provides positives and negatives to investing in gold. Since it is an asset that always has plenty of press interest it is natural that there is structured product activity particularly when the fundamentals are good. This year, there has been a significant increase in issuance to provide investors with an alternative way of investing in gold with the potential to provide income with structured products.

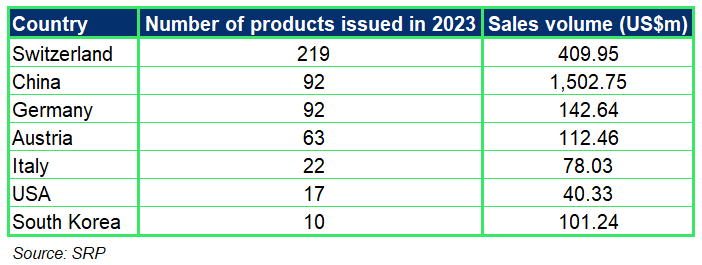

The table below shows structured product issuance in 2023 for the top seven countries by number of products, according to SRP data.

Switzerland, Germany and Austria occupy three of the top four entries and have very healthy sales volume totals. However, the Chinese market dwarfs all the others by sales volume indicating its very active position in gold-linked products, a position it has held since 2018.

The current StructrPro universe comprises 86,611 products (of which 42,562 are still live), 22 issuers, 385 underlyings, and 11 product types. In the fourth quarter of 2023, 2,798 structured products on the portal had strike dates.

J.P. Morgan was the main issuer in Q4 with a 19% share of the US market, up from 17.3% in the fourth quarter of 2022.

The bank’s offering included, among other, Digital Equity Notes (48134B5L3) on the S&P 500, which struck on 1 November and sold US$68.9m. The 1.5-year product offers a fixed contingent coupon of 15.8% at maturity if the index closes at or above 90% of its starting price. Its current spot is 112.55% (29 December 2023).

If we take a closer look at J.P. Morgan’s 637 products that struck during Q4 2023, we notice that 565 are currently in positive territory, with only 62 of its live products showing a mark to market loss. The 10 products that have already matured returned 13.2% pa.

Image: Brostock/Adobe Stock.