The bank has introduced its first equity-linked structure in Belgium since March 2023 as clients look to diversify their exposure.

Deutsche Bank has launched Europe Accelerator 2029 in Belgium.

The five-year, capital protected note offers 200% participation in the upside performance of the Eurostoxx 50, capped at 25%. The overall minimum capital return at maturity is 110%.

[The Eurostoxx 50] is a very well-known index on the market, easy and simple to understand by the investors, and benefiting from the support of our chief investment officer - Pierre-Yves Druenne

The product – issued on the paper of Deutsche Bank AG and distributed via Deutsche Bank Brussels – is the bank’s first equity-index linked structure since March 2023, when it launched Morgan Stanley & Co International plc (UK) Europe Autocallable 2028.

Since then, Deutsche has mostly focused on steepeners linked to the two- and 30-year EUR constant maturity swap (CMS) rate, and on fixed income solutions such as step-up notes and callable fixed rate notes, according to Pierre-Yves Druenne (pictured), head of capital markets & insurances Belgium at Deutsche Bank private bank in Brussels.

“Fixed income products are still triggering clients’ interest,” Druenne confirmed. “Nevertheless, we hear the clients’ needs to diversify their exposure in terms of underlyings while limiting the risk they take.

“In that respect Deutsche Bank Europe Accelerator 2029 offers the best of both worlds. It provides exposure to equity markets, with a cap, and the right of repayment of full capital at maturity, together with a minimum coupon of 10%,” said Druenne.

The latter [10% minimum coupon] is something appreciated by the bank’s clients.

“This limits the gap in terms of minimum return with a fixed income structure offering guaranteed coupons,” said Druenne.

The underlying Eurostoxx 50 index, which tracks the Eurozone’s biggest and most traded companies, increased by approximately 16% in 2023.

Deutsche’s analysts expect modest growth in gross domestic product (GDP) in the Eurozone for 2024 and in that context, earnings growth for companies in the Eurostoxx 50 is expected to post a single digit increase this year, while stock market valuations remain attractive.

“[The Eurostoxx 50] is a very well-known index on the market, easy and simple to understand by the investors, and benefiting from the support of our chief investment officer who has a constructive view on European equity markets,” Druenne said.

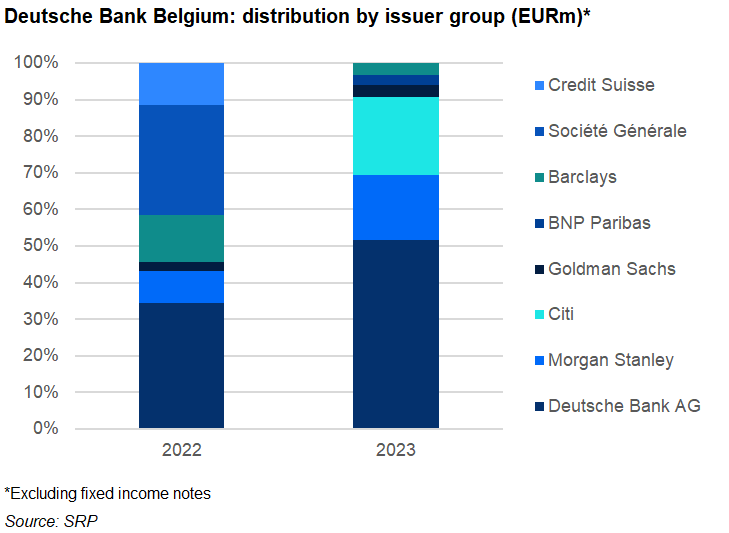

Deutsche distributed 20 structured products worth an estimated €300m (US$ 325.62m) in Belgium during 2023 (excluding fixed-income notes), compared to 28 products that sold €280m the previous year.

Ninety-five percent of 2023’s sales volumes were invested in 17 interest-linked structures with the remaining volumes tied to products linked to a single equity index (two) and the inflation (one). In total, six different issuer groups were used, including, among other, Deutsche Bank, Morgan Stanley, Citi and Goldman Sachs.

The bank’s best-selling product for 2023 was the Deutsche Bank AG (DE) Fixed Coupon Callable Note 2027, which collected €59m during its subscription period.

Deutsche Bank Europe Accelerator 2029 is open for subscription until 26 January 2024. The product is listed on the Luxembourg Stock Exchange but does not provide access to an active market. The minimum investment is €5,000.

Click the link to read the Deutsche Bank Europe Accelerator 2029 brochure (NL/FR) and key information document (NL/FR).