The Swiss bank continues to differentiate itself with concentrated single stock underliers in the US structured note market.

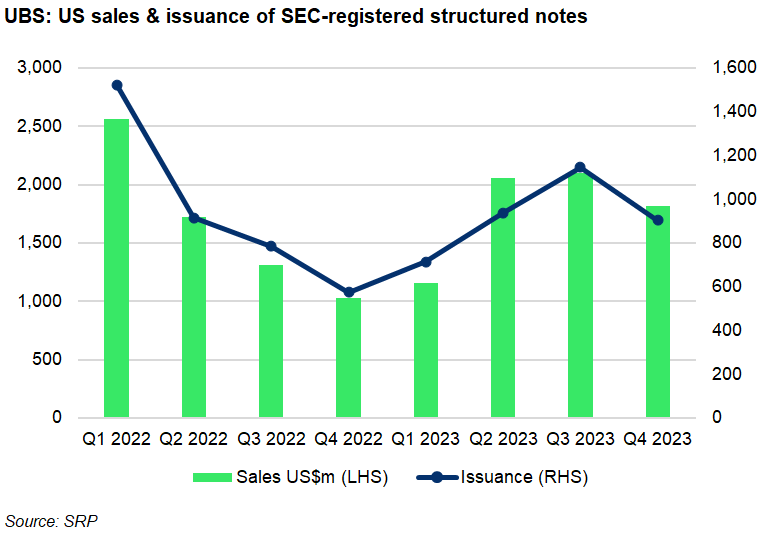

UBS closed the final quarter with US$1.8 billion traded notional booked for SEC-registered structured notes in the US, a 76.7% rise year-on-year (YoY). This translates to US$7.1 billion for the full year 2023, up 7.8% from 2022 which was on a downward trend following a robust first quarter.

As we move to the next phase of our journey, we will focus on restructuring and optimizing the combined businesses - Sergio P. Ermotti, CEO

In 2023, the Swiss bank’s sales volume significantly ticked up from the second quarter and remained at that level throughout the following nine months despite a lacklustre start, SRP data shows.

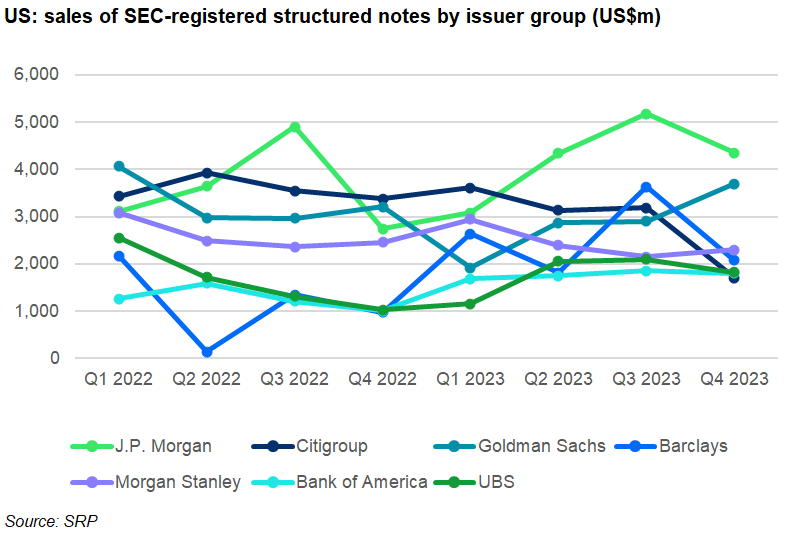

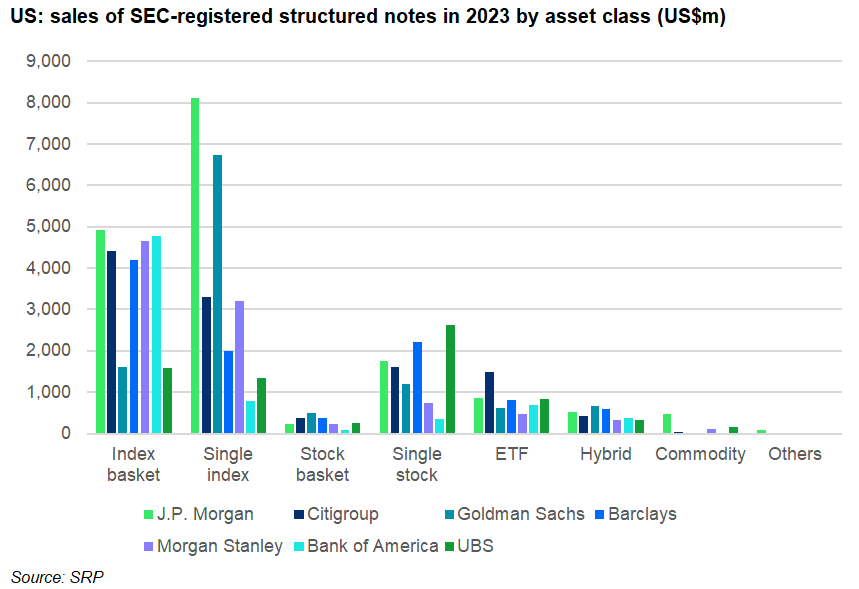

By year-end, the total volume at UBS chalked up 7.0% of the total traded notional of SEC-registered structured notes, which came to US$101.1 billion, up 8.1% YoY. This put UBS on par with Bank of America, which tailed behind J.P. Morgan (US$16.9 billion), Citigroup (US$11.6 billion), Goldman Sachs (US$11.4 billion), Barclays (US$10.2 billion) and Morgan Stanley (US$9.8 billion).

UBS Securities acts as the primary dealer for the notes on the paper of UBS AG, some of which are then sold to UBS Financial Services at a discount from the issue price. Third-party dealers include Goldman Sachs & Co and Morgan Stanley Wealth Management.

The offerings have an averaged ticket size of US$1.9m, which is the smallest among the top seven issuers. J.P. Morgan and Barclays sold US$2.2m and US$3.6m per issuance, respectively.

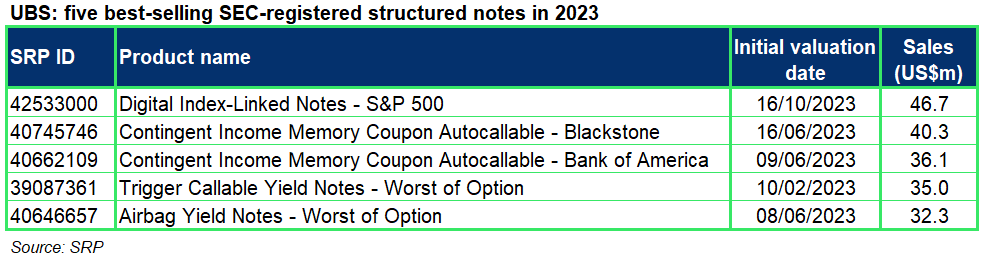

The ticket size is also reflected in UBS’ best-selling products in 2023, which were eclipsed by Bank of America’s despite similar total sales from the two issuers.

The bestselling product linked to the S&P 500 was made available on Simon Markets, the multi-issuer structured note platform. Next in line are phoenix autocallable notes on single stocks – BlackStone and Bank of America - both of which were issued in June 2023 with a three-year tenor.

At the same time, the Trigger Callable Yield Notes - Worst of Option (90289W557) is linked to the least performing of the shares of the iShares Russell 2000 ETF and Invesco QQQ Trust. The Airbag Yield Notes - Worst of Option (90279GNE5) in the fifth place has three reference assets: S&P 500, Dow Jones Industrial Average Index and Russell 2000.

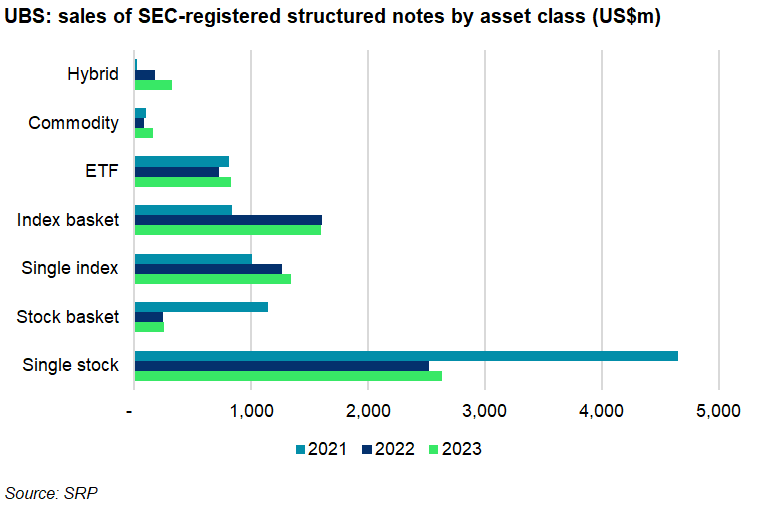

By underlying class, UBS differs from other top issuers with its wide use of single stocks for SEC-registered structured notes. Approximately 36.9% of the total traded notional, or US$2.6 billion, is linked to single stocks at the bank, which represents the highest proportion as well as the largest volume among the top seven issuers.

UBS has decreased the use of single stock underliers from 2021 when the asset class made up 43.9% of the total traded notional, or US$4.6 billion.

Meanwhile, index underliers chalked up US$2.9 billion traded notional – almost evenly split between index baskets and single indices, which accounted for 41.2% of the total at UBS. The percentage is significantly lower compared with larger issues where the percentages landed between 60.7% to 80.7%.

In contrast, Bank of America saw 78.7% of its traded notional linked to indices, or US$5.6 billion, primarily through index baskets in 2023. Equity underliers only contributed to 6.1%, or US$437m.

Besides structured notes, UBS AG issued 64 callable fixed rate notes with combined principal amount of US$773.1m during the year. Issued in January 2023, the Callable Fixed Rate Notes (90279FQ61) amassed US$72.3m with a one-year tenor, offering a fixed quarterly coupon of 5.0% pa.

Earnings

UBS reported a US$751m pre-tax loss, including US$508m related to its investment in SIX Group, for the fourth quarter of 2023. Accordingly, the profit before tax for the full year came to US$29.9 billion, including a US$28.9 billion negative goodwill impairment.

UBS’ merger with Credit Suisse is planned to complete by 30 June 2024 and the merger of UBS Switzerland AG and Credit Suisse (Schweiz) AG entities by 30 September 2024.

‘As we move to the next phase of our journey, we will focus on restructuring and optimizing the combined businesses. While our progress over the next three years will not be measured in a straight line, our strategy is clear,’ said Sergio P. Ermotti (pictured), CEO of UBS AG.

The ongoing consolidation of Credit Suisse is reflected in the increased revenues across all divisions for Q4 2023 year-on-year.

At the investment bank, total revenues increased 27% to US$2.1 billion. By unit, global banking revenues climbed 152% to US$505m while global markets revenues decreased four percent to US$1.3 billion. Execution services revenues increased 11% to US$414m with increases across cash equities and higher revenues from foreign exchange (FX) products that are traded over electronic platforms.

Additionally, derivatives & solutions revenues dipped 18% to US$446m, mostly driven by rates and FX, due to lower levels of both volatility and client activity, partly offset by higher equity derivatives revenues. Financing revenues rose one percent to US$442m.

For personal & corporate banking, pre-tax profit went up 39% to CHF701m as revenues almost doubled to CHF2.1 billion.

At global wealth management, profit before tax declined 64% to US$381m, mainly driven by higher operating expenses, partly offset by higher revenues, which included the impact from the acquisition of CS Group.

At the same time, pre-tax profit of asset management fell seven percent to US$115m on revenues of US$805m, up 63%.