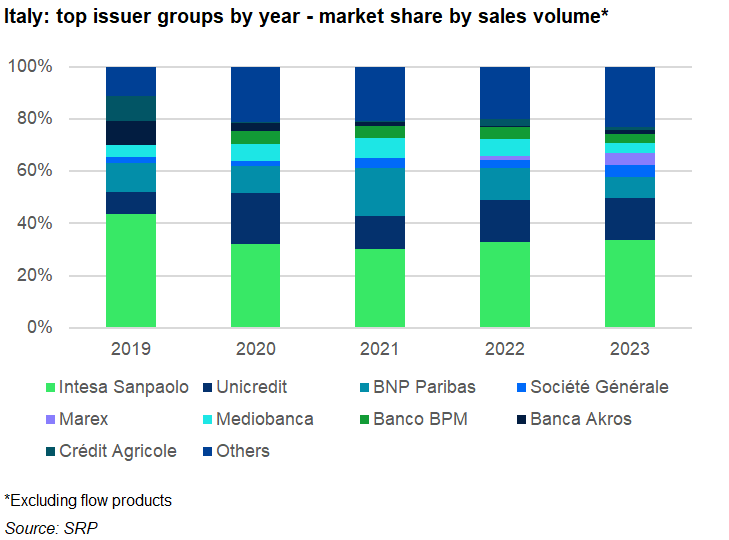

The Italian banking giant remains the second-largest structured product issuer group in 2023 with over 17% of the market share.

Unicredit S.p.A. finished the last quarter of 2023 strong with a pretax net profit jumping 11% YoY to €2.35 billion (US$2.53 billion), according to its latest earnings report.

The Italian banking group led by CEO Andrea Orcel (pictured) posted its 12th consecutive quarter of profitable growth in Q4 23. Revenue rose by over four percent YoY to €5.98 billion, €3.6 billion of which came from net interest income, up 5.7% YoY, supported by a favourable rate environment and its pass-through management. Fees stood at €1.8 billion, down 0.6% from the prior year's quarter.

For the whole of 2023, which it said was its ‘best year ever,’ the bank posted a 17% YoY increase in revenue at €23.8 billion. Pretax net profit soared 57% YoY to reach €11.5 billion in 2023, with the largest amount stemming from its home market of Italy, which gained over 28% YoY to €5.6 billion.

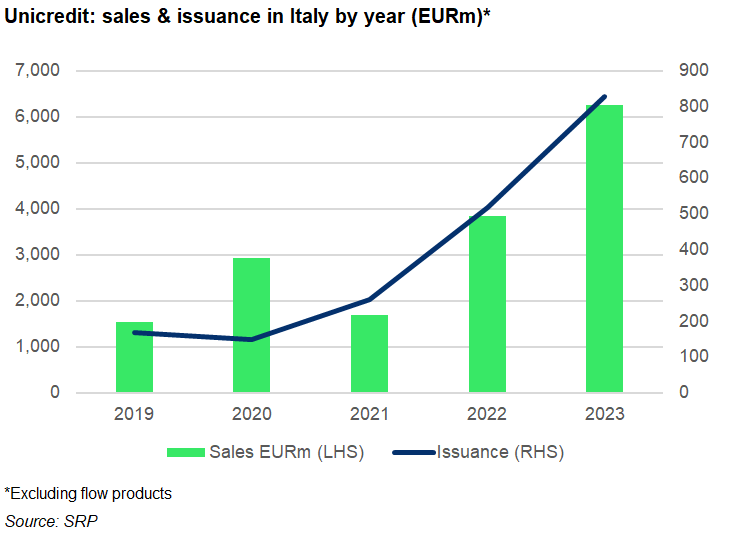

In the structured product space, Unicredit collected €6.26 billion from 826 products issued in Italy throughout the year, a 63% jump in volume compared to 2022 when the bank raised €3.84 billion from 517 products, according to SRP data.

With 17.7% of the market share in Italy in 2023, Unicredit maintained its title as the second-largest structured product issuer group in its home market from 2022, after Intesa Sanpaolo (37% of the market share).

Out of 826 products Unicredit issued, 410 were linked to single stocks, with banks, automobiles and parts, and oil and gas industry-focused underlying continuing to dominate as the overarching theme this year. Popular underlyings include Intesa SanPaolo (20), its own share (18), Stellantis (17), Enel (16), Eni (13) and Tesla (13).

Other asset classes also saw growth on all fronts. In 2023, the bank issued 239 products on the back of a shared basket of stocks, 112 tied to a single index, and 52 tied to a shared basket of indices. The Cash Collect - Protect Memory, for instance, a five-year 100% capital protected investment certificate tracking the Stoxx Europe ESG Leaders Select 30 EUR Index, achieved sales of €65.8m.

There were also nine products tied to interest rates, three linked to inflation, and one hybrid product. The best-selling product in the interest rates category came to the EuroTLX-listed, digital investment certificate Cash Collect Protection 100% 28.11.2025 on the back of three-month Euribor rate, collecting €46.9m in sales.

Outside of Italy, Germany, where revenues totalled €5.4 billion for the year, up 7.5% YoY, saw most of the bank’s structured product issuance with 7,504 products.

Most of these (7,115) were linked to single stocks, while some 341 were tied to a single index. Volkswagen (638) surpassed Mercedes Benz Group to become the most seen underlying used in those equity-linked products issued by the bank last year, followed by Siemens (539) and Allianz (387). Many of these are certificates.

Equities aside, Germany also saw 16 fund-linked and three credit-linked notes (CLNs). The latter category includes the HVB Bonitätsabhängige Schuldverschreibung bezogen auf Bonität auf Deutsche Bank, a 2.9-year note on the credit risk of Deutsche Bank, which gathered €20m in sales.

Unicredit also remained active in the Central and Eastern Europe region, issuing structures in the Czech Republic (256) last year. Most of them were barrier reverse convertible investment certificates tracking single stocks.

Click the link to read Unicredit’s full Q4 and full year 2023 results release, divisional database, and presentation.

Do you have a confidential story, tip or comment you’d like to share? Write to jocelyn.yang@derivia.com