Both Swiss private banking giants finish 2023 with flat assets under management. Julius Baer grapples with a tumble in net profit, while EFG International has a record high in net profit.

Julius Baer saw its assets under management (AuM) edge up one percent to CHF427 billion (US$485 billion) in 2023 compared to the prior year, driven by strong stock markets and net new money, according to the Swiss private banking giant’s 2023 earnings report.

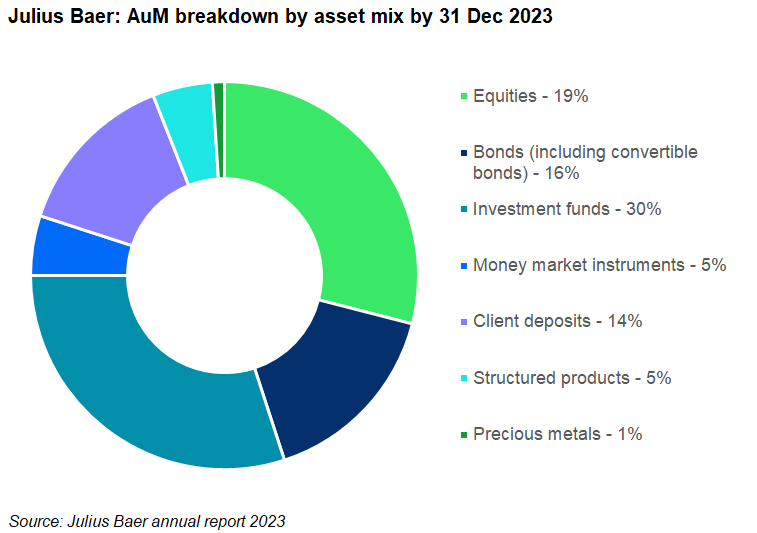

Structured products accounted for five percent of total AuM in 2023, one percent higher than a year ago when it accounted for four percent.

The bank’s operating income dropped by 16% year-on-year (YoY) to CHF3.2 billion, impacted by the full loss allowance for the largest private debt exposure, which resulted in net credit losses of CHF586m.

However, net income from financial instruments measured at fair value through profit or loss went up by one percent YoY to CHF1.06 billion by the end of December. Among, treasury swap income benefited from ‘a rise in differentials between mainly US and Swiss interest rates,’ but the increase was largely offset by ‘the negative effect of lower volatility’ and ‘reduced client activity on trading income.’

Groupwide, its IFRS net profit tumbled more than 52% YoY to CHF453.4m in 2023, with the second half of the year seeing a CHF78m loss.

SRP database registered 23,203 investment certificates and 9,142 medium-term notes distributed by Julius Baer in the Swiss market in 2023.

Out of over 23,000 certificates, a shared basket of equities is the most widely used asset class (13,442), followed by single stock (6,841), a shared basket of indices (1,658), ETF (510), FX rates (434), hybrid (162), single index (131), real estate (25), and fund (17).

More than half of medium-term notes are also in a share of equity baskets, with many focusing on featuring technology and services and automobile and parts underlying sectors. The majority of these notes feature autocall payoff.

The group's rocky year also included a leadership shuffle. The bank noted in the report that CEO Philipp Rickenbacher, who had been with the firm since 2004 and was head of structured products until he took the top job at the bank in 2019, stepped down. Nic Dreckmann (pictured), the current deputy CEO and chief operating officer, has become interim CEO.

EFG International

EFG International’s AuM also remained stable in 2023, reaching CHF142.2 billion compared with CHF143.1 billion seen in 2022, according to the Swiss private bank’s full 2023 earnings report.

The latest figure reflects the ‘negative impact of the stronger Swiss franc, which more than offset net new assets and positive market performance,’ the bank said.

The bank, led by CEO Giorgio Pradelli (right), also posted CHF24.5 billion in assets under administration (AuA) last year, which are trust assets, and CHF7.4 billion assets under custody as of the end of December.

Out of the combined AuM and AuA, structured notes accounted for 2.6%, or CHF4.29 billion, roughly the same as in the prior year (2022: CHF4.22 billion).

Total derivatives assets were down 12.8% to CHF1.57 billion, while derivatives liabilities slid four percent to also CHF1.57 billion from a year ago.

In the whole year 2023, the Swiss private bank collected CHF1.43 billion in operating income, up 12.6% YoY. Operating expenses, recorded at CHF1.06 billion, also increased by 8.7% YoY. International IFRS net profit increased 50% YoY to CHF303m, reaching a new ‘record’ high, the bank stated.

Net new assets reached CHF6.2 billion in 2023, a 32% higher compared with the prior year.

EFG International noted its gain in new assets is partially attributed to its expansion of talent base and client coverage, with 141 new hires of client relationship officers across the regions, with a particular focus on Asia.

Click the links to read the full-year 2023 earnings reports of Julius Baer and EFG International.

Do you have a confidential story, tip or comment you’d like to share? Write to info@derivia.com