In an industry first, the UK Structured Products Association (UKSPA) has launched Portfolio Optimiser – a free tool that enables advisers and wealth managers to see how structured products can complement and enhance a wider investment portfolio.

“At a time of significant market uncertainty, financial advisors now have for the first time at their fingertips the tools to allow them to help optimise their clients portfolio, using structured products to deliver enhanced risk return profiles,” Zak de Mariveles (pictured), chairman of the UKSPA, told SRP.

“Portfolio Optimiser provides detailed analysis, at a client portfolio level, allowing advisors to mix funds and structured products seamlessly within a client’s portfolio and provide an independent audit trail as to the expected benefits.”

Backed by data from Future Value Consultants (FVC), the new tool provides an independent and objective assessment of how structured products can fit into an existing portfolio and impact the expected performance and risks.

Investing without structured products is like playing a team with one man down - Zak de Mariveles

While many applications exist to analyse portfolios made up of funds and exchange-trade funds (ETFs), the UKSPA’s Portfolio Optimiser is the first opportunity for users to allocate to structured products within a model portfolio framework.

“Investing without structured products is like playing a team with one man down – it’s harder to compete if key players are missing,” said the Mariveles. “Portfolio Optimiser offers independently verified data for all advisers and wealth managers to use to assess the impact structured products can have on any portfolio’s expected risks and returns. We hope it provides reassurance for those considering using structured products as a way to diversify and enhance investment portfolios.”

Portfolio Optimiser allows users to either create their own structured product for analysis, or select a product that is currently listed on FVC’s Structured Edge research service. The new tool can also be used to build a portfolio and offers a number of pre-built model portfolios or the chance to build a custom portfolio from a comprehensive list of ETFs and funds across all asset classes and IA (Investment Association) sectors.

Once the user has decided how much of the portfolio to allocate to the structured product, Portfolio Optimiser generates a detailed report of both historical and forward-looking analysis, comparing the original portfolio to the ‘modified’ version (ie with the structured product included).

“Over the last 10 years structured products have been outperforming many funds, and we are excited to provide for the first time a tool to the adviser and wealth management market that will help them better understand how to optimise their allocation across a clients’ overall portfolio,” said de Mariveles.

Recent performance

A recent analysis published by FVC’s Structured Edge research service shows that there were 1,172 index-linked structured products (those linked to the FTSE 100 and other mainstream indices) maturing in the UK market between 1 January 2016 and 31 December 2019.

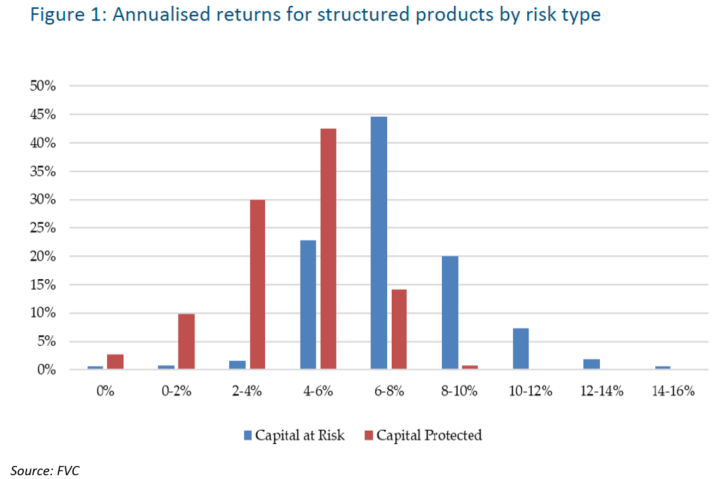

These break down into 918 capital-at-risk product (78% of the total) and 254 capital-protected products (22%) which serve the two parts of the market divided by the most fundamental investor choice – attitude to risking any loss of capital.

According to the research, none of the 1,172 products maturing during that period returned losses, and the average return was 7.24% pa for capital-at-risk products and 4.08% pa for capital-protected products. The average over the entire set of products was 6.56% pa.

“These figures are remarkable and show how robust and reliable the market has been,” said Tim Mortimer (above right), managing director at FVC. “It would be almost impossible to find any sector in any cycle from the fund world where every single one of over 1,100 funds over a four year horizon would not have a single one losing money.”

Equity markets were broadly positive during this period and therefore capital at risk products as a group performed stronger as we should expect, according to Mortimer. “However there has been some market volatility and the capital protection features of barriers (set at levels typically between 50% and 65% of the initial index level) helped prevent losses for any of the products in the study,” he said.

Figure 1 illustrates the distribution of returns for capital at risk and capital protected products over the last four years of maturities.

Asset class comparison

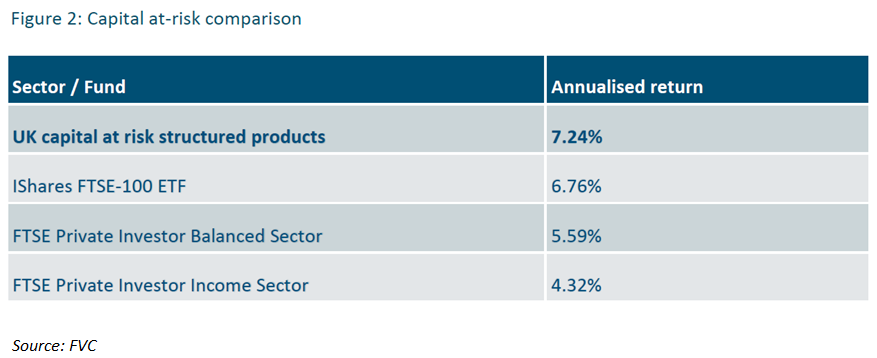

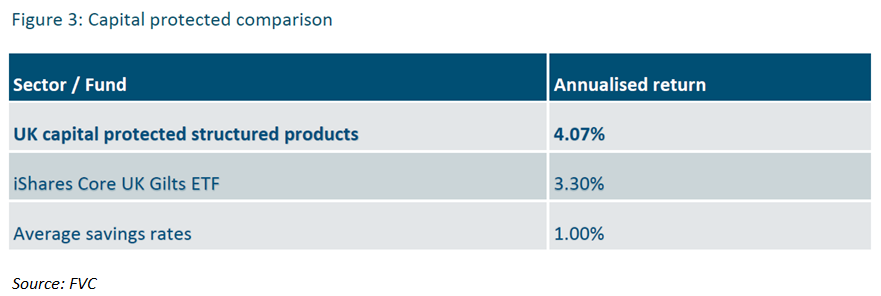

The research also compares the performance of structured products versus five investment alternatives over the same period including the iShares FTSE 100 ETF to represent direct equity holdings, the balanced and income versions of the FTSE Private Investor benchmark series, and the iShares Gilt ETF to follow the bond market and proxy for deposit investments represented by cash returns.

Each of the structured products in the sample was measured over their full investment term.

Figure 2 shows that capital at risk structured products over this period have outperformed direct equities and both the private investor benchmarks, which between them represent popular choices used by thousands of advisers for their clients.

Figure 3 shows that the performance of capital-protected structured products beats both the bond ETF and cash returns which are representative of deposit accounts.

The research concludes that for investors seeking equity like returns at controlled risk capital-at-risk structured products actually outpaced the equity market and clearly outperformed investor benchmarks over the last four years.

In addition, the capital protected portion of the market, usually issued in a deposit wrapper with FSCS protection in the event of issuer default easily beat cash returns and have also outperformed bonds.

“With market direction remaining difficult to predict, the variety of structured products currently available in the UK market offer investors the chance to target market leading returns while selecting full or partial capital protection to suit their needs,” said Mortimer.