The non-banking issuer is responding to demand for crypto structures linked to assets that are well positioned to weather out the crypto winter.

Marex Solutions has issued a new structured product linked to the performance of the Coinbase (COIN) share.

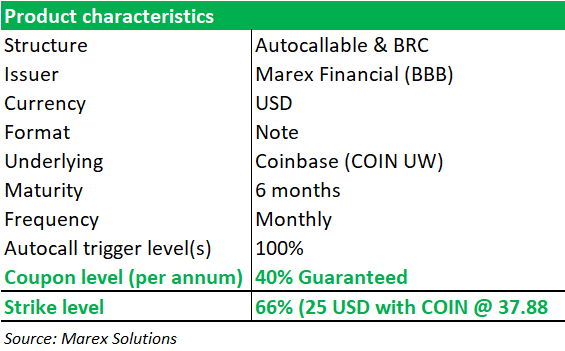

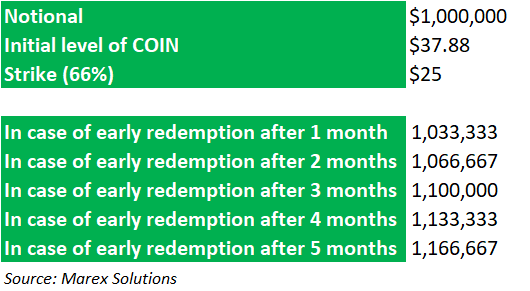

The six-month barrier reverse convertible (BRC) note issued yesterday (4 January) offers a guaranteed 40% coupon p.a. paid monthly. The autocallable structure includes a predefined downside barrier at 66% of the stock's price listed on the Nasdaq exchange - US$37.8 on the issue date, and will mature early paying the initial capital plus the coupon at any observation date if the underlying value is above the strike price.

Many investors have the view that Coinbase will be one of the survivors - Ilan Solot, Marex Solutions

The product will repay the capital invested at maturity as long as the shares stay above US$25 during the six-month term - If the downside barrier is touched or breached, investors will be allocated Coinbase shares at US$25, and participate one to one with the share’s performance.

"Many investors have the view that Coinbase will be one of the survivors, that they could gain a lot of market by positioning themselves as the anti-FTX, being publicly traded, fully U.S. regulated, and offering a reliable corporate and custody service," said Ilan Solot (pictured), co-head of digital assets at Marex Solutions.

"But with the stock price so volatile and so much near-term uncertainly, a lot of investors prefer to express it via structured product where they can get an attractive guaranteed coupon plus a lot of downside protection, thanks to extremely high implied volatility in the options market.”

The Coinbase share dropped nearly 86% to US$35 last year as a result of the Federal Reserve's monetary tightening and the collapse of several major crypto firms, including stablecoin issuer Terra and rival crypto exchange FTX.

According to Solot, bitcoin implied volatility is historically low (~40) while Coinbase (highly correlated to BTC) implied volatility is still very high (100+).

“This means that many investors looking to generate yield from crypto-linked assets see Coinbase share as more attractive based on current pricing,” he said.

Marex is also issuing similar products on bitcoin (34% protection, 6 months), but with a lower guaranteed coupon of ~ 15% pa. In this case, investors only start to lose money if bitcoin falls to about US$10,300, but the upside is only 15%; if BTC doubles next month, they still only get 15%.

Marex has become the main provider of crypto structured products in the institutional market since adding the new asset class to its offering in January 2021 via customised OTC and structured notes.

"2022 has been an interesting year for crypto linked investments with the drop in market value and challenges the industry faced, this cemented our positioning as a FCA regulated counterparty for crypto derivatives and issuer of crypto linked notes," said Joost Burgerhout (right), head of Marex Financial Products.

"Whilst there are many exciting projects out there, our offering gives investors comfort as the payoffs are linked to the performance of the referenced underlying without adding additional exchange or protocol risk."

According to Burgerhout, many investors remained sidelined for most of 2022 for directional crypto exposure, however Marex saw interest in yield enhancement structures playing on sideways movements towards the second half of the year.

"We have seen interest in yield products linked to Coinbase towards the end of the year after a strong drop in the share price and the view by investors that Coinbase will be one of the survivors in this space being publicly traded in the US and regulated," he said.

For 2023 the issuer expects this trend to continue regardless of movements on underlying markets.

"We expect to continue to see investors looking for trustworthy counterparties and issuer for crypto linked investments. We continue to expand our offering in this space, having made several senior additions to the team in 2022. There will be more coming from us soon," said Burgerhout.

The UK-based non-banking issuer has manufactured several derivatives in a structured note format including the world’s first autocallable linked to bitcoin, other coins such as ethereum, as well as decentralized protocols, correlation products between crypto assets and cash and carry trades.

This is the first structured note linked to the Coinbase share since the two firms entered an institutional partnership at the end of 2021 to leverage Marex Solutions’ issuance and trading capabilities and Coinbase Prime’s crypto custody, liquidity and prime services.