In the second of a two-part article, we look at the main ESG markets in Europe, the dominant index providers in the segment, and thematics that caught the eye.

In part one of our analysis, we noticed that sales for structured products linked to ESG underlyings in Europe during 2023, at an estimated US$9.6 billion (from 1,475 products), were down 36% compared to their peak in 2022, when US$15.1 billion was collected from 2,482 products.

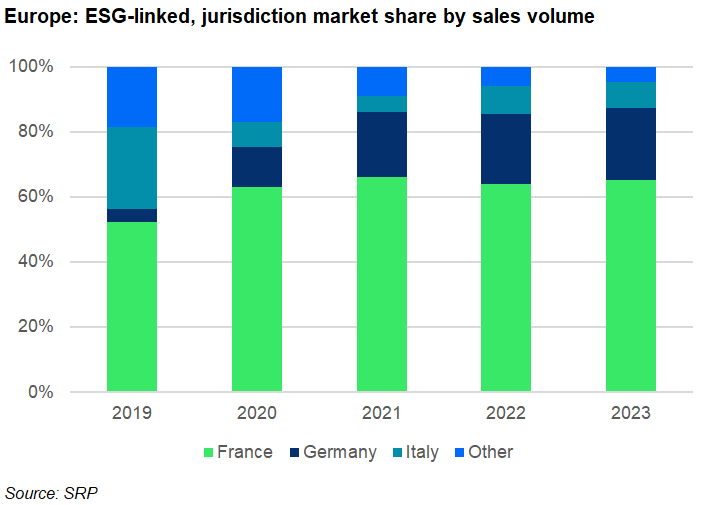

France is by far the biggest European market for ESG-linked products, ahead of Germany and Italy. Together they claimed a market share of 95% by sales volume in 2023, of which the French market captured 65%, a figure which was almost on par with that for 2020-2022, but 13 percentage points above the 52% market share it held in 2019.

Some of the most successful ESG underlyings in the French market during the past five years included the SBF Top 50 ESG EW Decrement 50 Points, which was seen in 213 products worth an estimated US$2.7 billion and the Euronext Climate Objective 50 Euro EW Decrement 5% Index (US$2.7 billion from 33 products) while the iEdge ESG Transatlantic SDG 50 EW Decrement 5% NTR Index was the main ESG index in 2023 with sales of US$830m from 12 products.

Italy, which had captured 25% of the European ESG market in 2019, has seen its market share drop sharply in the following years (2023: nine percent) with Germany the main beneficiary. In 2023, some 1,140 ESG-linked products worth an estimated US$2.1 billion were issued in the German market with more than half of the sales coming from 634 products tied to the MSCI World Climate Change ESG Select 4.5% Decrement EUR Index, which was exclusively licensed to Deka Bank.

The 21 ESG-linked products issued in Italy during 2023 sold around US$770m with the highest volumes invested in five structures linked to the Stoxx Europe ESG Leaders Select 30 EUR Index (US$320m).

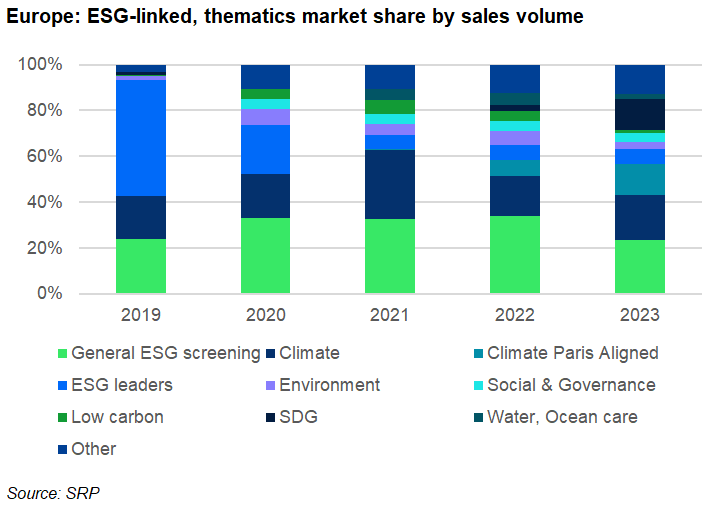

On the subject of ESG leaders, indices tracking them claimed seven percent of the market in 2023, a significant drop from 2019 when their market share was 50%. Indices with ESG screening based on extra-financial criteria, remain an important part of the offer– their market share has never been below 24% in the past five years.

The same applies for climate indices (19 to 30% market share) while Paris-aligned benchmarks (PAB), which first appeared in 2022, captured 14% of the market in 2023, driven, among others by sales from products linked to the S&P France 40 Paris-Aligned Transition ESG 5 % Decrement Index (US$285m), S&P Eurozone 50 Net Zero 2050 Paris-Aligned Select 50 Point Decrement Index (US$135m), S&P Eurozone 50 Net Zero 2050 Paris-Aligned Select 5% Decrement Index (US$110m).

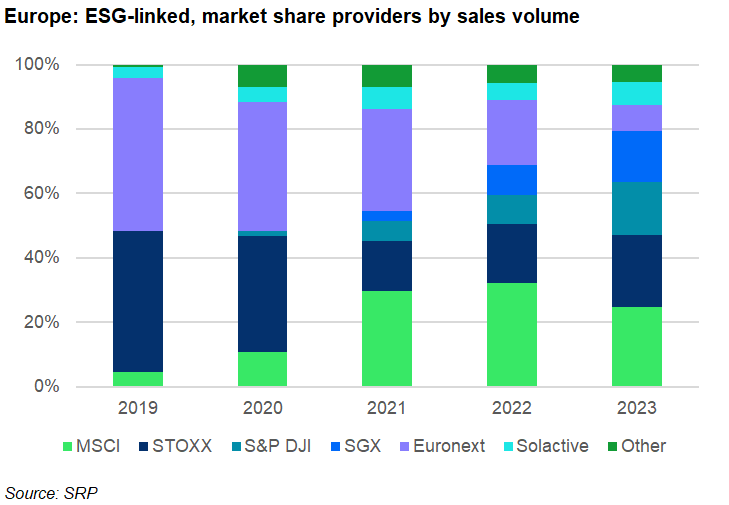

Products linked to MSCI’s ESG indices captured 25% of the European market in 2023, ahead of STOXX, S&P Dow Jones Indices, SGX, Euronext and Solactive.

MSCI has come a long way since 2019 when its ESG indices were used in only 23 products across Europe. However, since then it has gone from strength to strength, peaking in 2022 with a 32% share of the European market and even though its market share dropped by seven percentage points in 2023, it remained the biggest underlying provider for ESG products, with 26 of its indices linked to 972 products worth an estimated US$2.4 billion.

STOXX is another index provider that continues to claim its stake. In 2023, products linked to its ESG indices sold an estimated US$2.2 billion – equal to a 22% market share – although it needed far less products than MSCI to achieve this: 91 products versus 972 for MSCI.

S&P Dow Jones Indices held a market share of 16% in 2023, its highest in the past five years, and mainly on the back of strong sales of products linked to its PAB indices, 12 of which were used during the year.

SGX also captured 16% market share, again, like S&P DJI, its best performance in the period 2019-2023 while Euronext’s market share went from very strong in 2019 and 2020 (47% and 40%, respectively) to strong in 2021 and 2022 (32% and 20%), to slightly disappointing in 2023 (eight percent). The latter was achieved from 34 products that sold an estimated US$785m including two products linked to the Euronext World Sustainability and Climate Screened Decrement 50 Point Index that were worth a combined US$225m.

Image: Deemerwha Studio/Adobe Stock.

Do you have a confidential story, tip or comment you’d like to share? Write to info@derivia.com