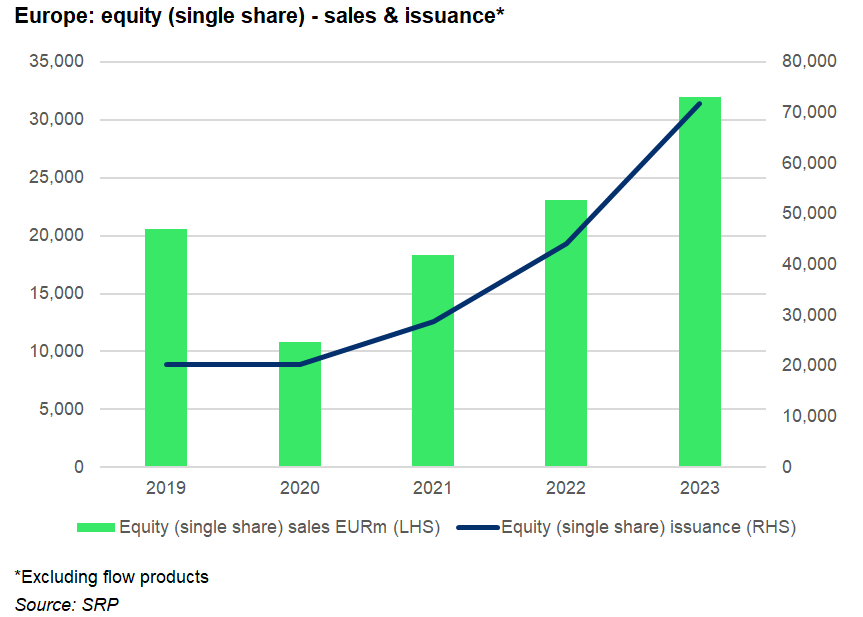

Turnover of structured products linked to a single stock increased by 41% YoY in Europe during 2023.

Despite losing some of its market share to rates-linked products, equities, as an asset class, continued to grow across Europe in terms of sales driven by the market rally in 2023 – this trend has extended into the first quarter of 2024.

Single index-linked products have traditionally made up the largest proportion of structured products linked to equities. However, products linked to baskets of stocks and single names have increased their presence in investors’ portfolios, becoming particularly popular in some markets in 2023 and Q1 2024.

In this article we will focus on products linked to a single stock underlying.

The traded notional of single stock-linked products reached an estimated €32 billion (US$34.1 billion) in 2023, up 41% year-on-year (YoY), and an increase of 50% since 2019, with an average growth rate of 21% pa.

Meanwhile, the European market added 87% between 2019 and 2023, with an average growth rate of 22% pa. for the last four years.

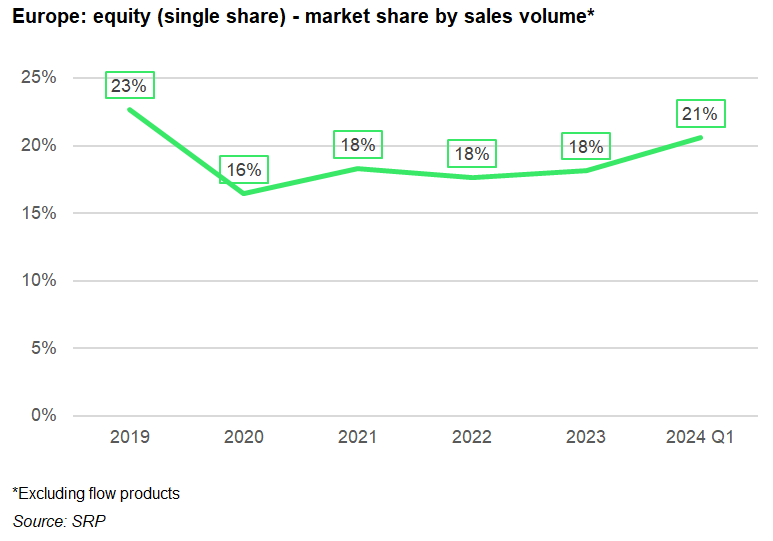

In 2023, structured products linked to a single stock made up nearly a third of the issuance across Europe while accounting for 18% of the total sales volumes. Their market share has remained virtually unchanged despite the overall decreasing exposure to equities due to the stacking of yield with interest rate-linked capital guaranteed products.

Additionally, the low levels of equity volatility since Q4 2023, and the equity markets being at historically high levels, have also led to better risk/return profiles with capital protection rather than conditional protection as is the case with yield optimisation products such as equity-linked autocallables.

The most frequently referenced stock underlyings in 2023 were Tesla (2.8K products), Nvidia (1.7K products) and Volkswagen (1.5K products).

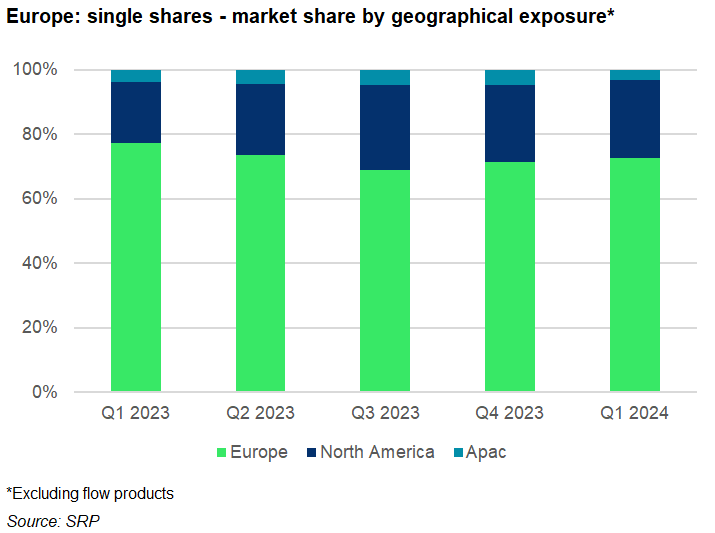

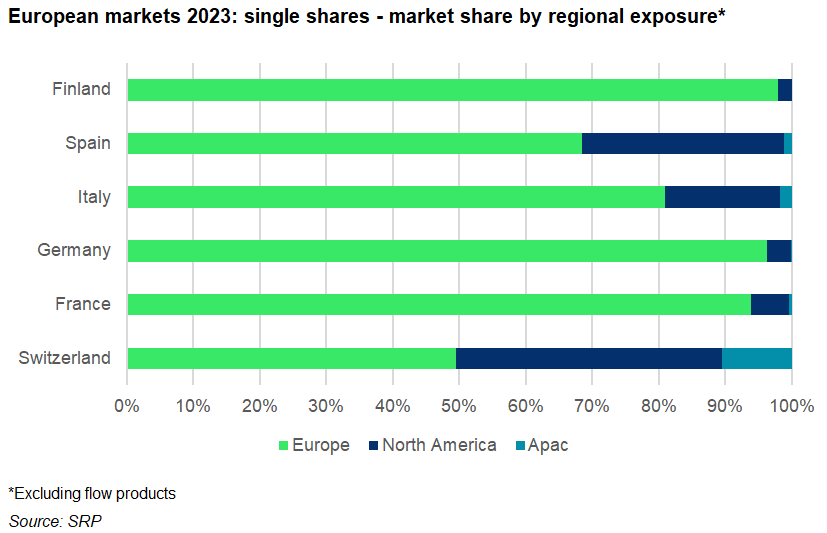

In terms of geographical exposure, there was a gradual shift towards US-based companies, whose market share increased from 19% in Q1 2023 to 26% in Q3 2023 at the expense of domestic companies. The next two quarters, however, failed to confirm a trend shift, as the share of European stocks-linked products stabilised.

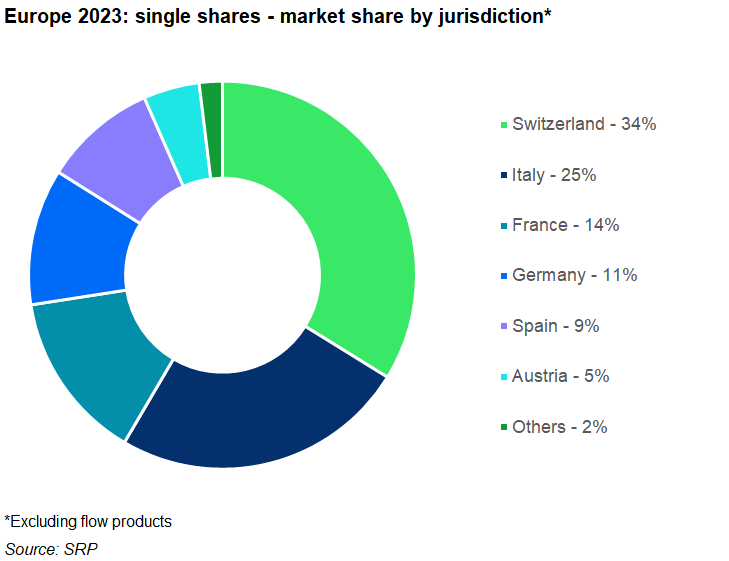

Switzerland is by far the largest market for products linked to single names, accounting for over a third of the single stock-linked segment. The Swiss market also has the largest exposure to US-based equities.

In 2023, 52,328 stock-linked products were issued in Switzerland. Of these, 2,674 were linked to the performance of Tesla. In Q1 2024, the most featured share was Nvidia which appeared across 809 products striking between January and March.

In Switzerland, the estimated notional linked to European companies fell from 56% to 49% between Q1 2023 and Q1 2024. The exposure to Asia Pacific companies was also down for the same period: from nine percent to six percent. During this period the most utilised European stocks were the shares of Roche, Richemont and Lonza, accounting for five percent of the single stock-linked notional in 2023.

The Italian market is the second largest European market for single stocks-linked products, representing a quarter of the notional issued in 2023. The estimated notional linked to European companies rose from 76% to 91% between Q1 2023 and Q4 2023. The shares of Eni, Enel and Intesa SanPaolo were the most referenced stocks, accounting for a quarter of the single stock-linked notional in 2023.

The shares of Amazon, Tesla and Meta were the most popular US companies used in structured products in Italy. They were used as the underlying for 67 products issued during the year.

In France, Société Générale, BNP Paribas and Stellantis were the most in-demand single names in 2023. Products linked to these companies collected an estimated €2.6 billion, representing more than half of the volumes raised by a single stock underlying.

Notably, 45% of the €825m collected by products linked to the share of Société Générale in France were linked to an index replicating the performance of the stock by reinvesting the gross dividends paid by the stock and detaching a fixed dividend in points.

Single-stock decrement indexes represent a substantial part of the notional raised by the top 10 stock-linked products in France: 45% of the exposure to the share of Stellantis was wrapped as an index; BNP Paribas index-linked volumes account for 22% of the overall exposure to the company’s share performance; and 75% of the exposure to the share of Credit Agricole is also packaged as an index.

Using these indices makes it possible to set the level of dividends typically at a level in line with historical dividends, to tackle the trading burden and obtain a significant pick up on the pricing compared to an investment in the share itself.

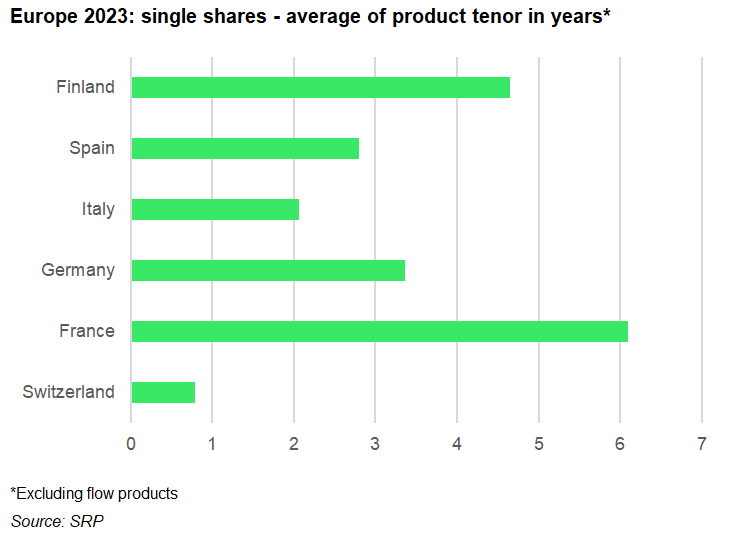

France remains by far the main market for this type of index wrapped exposure to single shares, but they have also gained visibility in Finland due to the market’s specific bias towards long-term structured products, for which hedging the dividend is most impactful. The longer the maturity, the higher the pickup because the forward differential increases.

The average tenor for single-stock products is the longest in France, at just over six-years, while the shortest maturities are seen in Switzerland, where such structures expire within a year.

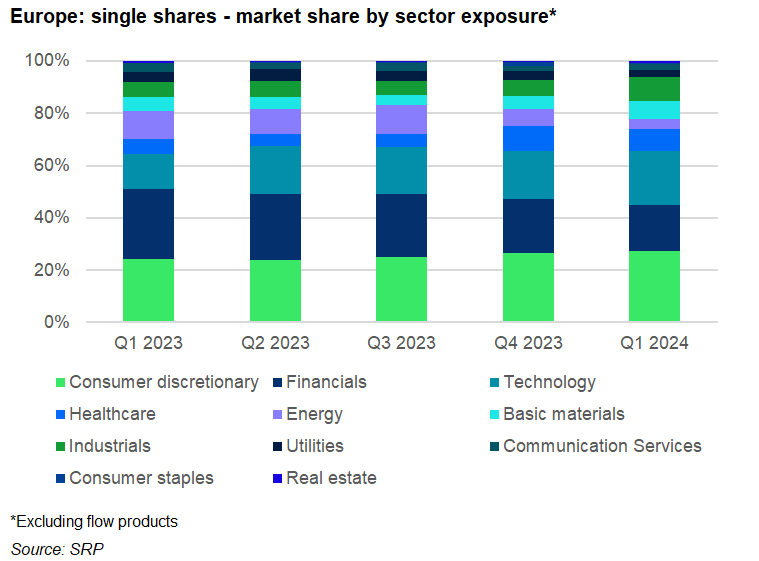

In terms of thematic exposure, there was a sustained increase in the demand for products linked to the consumer discretionary and technology sectors. Their market share reached 27% and 21%, respectively, in Q1 2024, up from 25% and 17% in 2023.

The demand for these sectors has been supported by the rebound in cyclical stocks on the back of favourable perspectives for the economy and the IT technology sector rally in Q1 2024.

Other sectors with positive year-on-year growth were healthcare (+31%), basic materials (+14%) and industrials (+46%).

The financial services and the energy sectors experienced a negative YoY growth in Q1 2024 (-41% and -65%) - the market share of the financial services sector shrunk from 24% to 17% while that of the energy sector decreased from 10% to four percent.

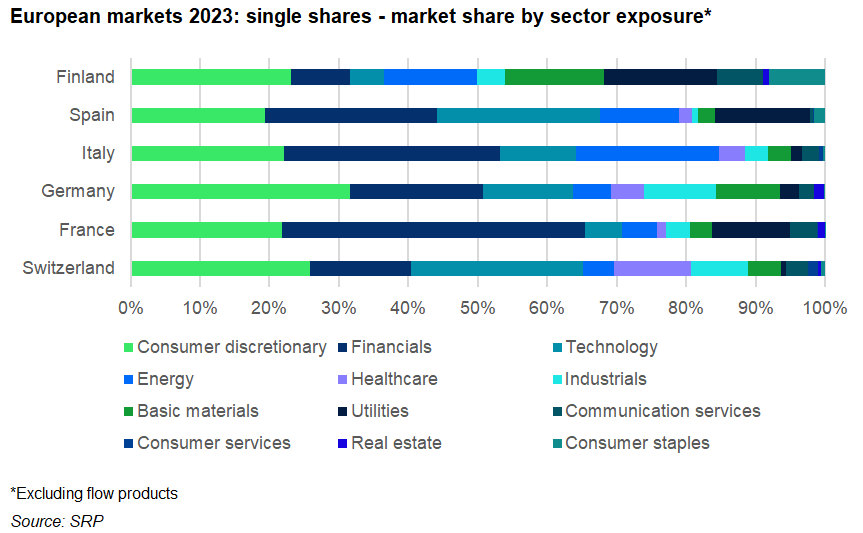

The consumer discretionary and technology sectors were equally represented in Switzerland, accounting for half of the notional in 2023. The next two significant sectors in Europe’s largest structured product market were financials (15% of the notional) and healthcare (11%).

Consumer discretionary was also the most popular sector in Germany (32% of the notional) and Italy (22%) in 2023.

The banking sector has had a dominant position within the single stock-linked segment in France and Italy, with the latter also having a solid exposure to the energy sector (21% of the notional).

Main image: Paopano/Adobe Stock.

Do you have a confidential story, tip, or comment you’d like to share? Write to info@structuredretailproducts.com